Greater capacity across North America a net positive for oilseed growers

Matt McIntosh, farmer and writer

IN ANTICIPATION OF continued growth in demand for soybean meal and biofuels, North Dakota has recently expanded its soybean crushing capacity with a facility capable of processing 150,000 bushels of soybeans per day.

North of the border, Canadian soybean industry representatives see the development as a net positive for soybean growers in Manitoba. And with the right policies, Manitoba could help feed the American crush facilities while simultaneously developing domestic processing capacity.

INCREASED DEMAND FROM LIVESTOCK SECTOR

Opening in September of 2023, the Green Bison soybean processing facility in Spiritwood, North Dakota, is the state’s only dedicated soybean crushing facility. A joint venture between ADM and Marathon Petroleum, it joins two existing ADM plants that handle canola, sunflowers, and a variety of other processing oilseeds including soybeans. Once running at full-steam, the facility will produce 600 million pounds (approximately 272 million kilograms) of refined soybean oil and 1.28 million tons of soybean meal annually.

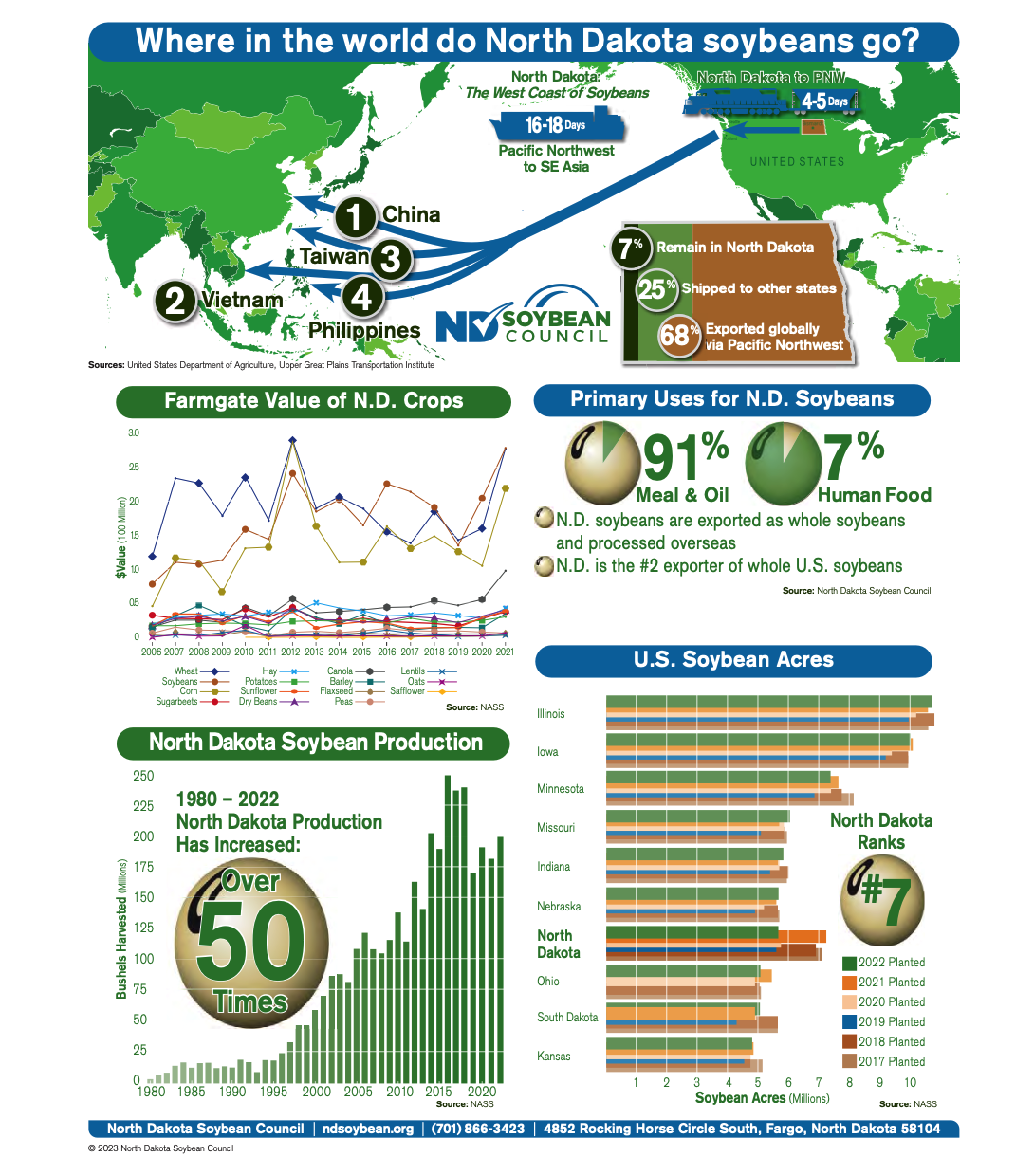

According to Stephanie Sinner, executive director of the North Dakota Soybean Council, the hope is that the significant addition to the state’s crush capacity will enable the region’s soybean producers to fill two growing markets – meal and oil – in addition to the already well-established whole soybean

market in China, Vietnam, Taiwan, and the Philippines.

“North Dakota is and will continue to be an exporter of whole soybeans through the Pacific Northwest ports. We’ve not had dedicated crush for soybeans in the state ever. Now we will also have soybean meal to export, although the hope is we will use that soybean meal domestically as a ration ingredient for livestock,” says Sinner.

“There’s definitely a concerted effort to expanding livestock operations in the state. Our hope is species that consume soybean meal as part of a regular ration will be able to access a locally grown and sourced ingredient. Pork, poultry, and dairy is what comes to mind. For Northern grown soybeans, they tend to be lower in crude protein. But when you look at the overall quality package of the soybeans, we tend to be higher in essential amino acids, which is critical to livestock diets.”

SOYBEANS KEY TO FUEL EMISSION TARGETS

As ADM and Marathon Petroleum highlight, the Green Bison facility will also be critical in helping states and cities across the United States reach emission reduction goals through biodiesel. Indeed, Sinner says demand for biodiesel and other renewable fuels is enormous and comes at a time when North Dakota farmers are significantly expanding soybean acres. Soybeans are proving to be both profitable and a good rotational fit.

“Putting biodiesel into the pipeline is a way to very quickly get those states and cities to those clean air standards,” she says, adding the current Environmental Protection Agency mandate for renewable fuels – 20.94 billion gallons for 2023, and 21.54 billion in 2024 – are well short of what oilseed growers could supply.

“The demand is there for fuel, which means demand is there for the ingredients. That’s the demand pull. We continue to see that going very strongly.”

POSITIVE NEWS FOR MANITOBA GROWERS

In Manitoba, the number of soybean acres seeded has seen a general upward trajectory since the early 2000s. Particularly significant growth has occurred since 2013, with over 1.57 million acres planted in 2023.

Chris Vervaet, executive director for Canadian Oilseed Processors Association, says while actual acres planted in soybeans continues to vary year-over-year due to environmental conditions – growers are less likely to plant soybeans when conditions are very dry – the overarching upward trend and generally good yields means Manitoba could potentially see investment in soybean crush capacity similar to what has been achieved for canola in recent years. Prairie provinces should continue to promote their tax credit programs to attract biofuel production.

“In the recent past, before we saw an increase in interest for renewable fuels, a big challenge was finding a home for soybean oil. Where was the soybean oil going to go, and go competitively, so it’s not just finding a market to get rid of it?” says Vervaet, adding lower protein levels have also been a challenge to finding new markets, while logistical and labour issues are perennial considerations for any company looking to invest in the province.

Regardless of the challenges facing increased crush capacity in Manitoba, he considers developments south of the border to be positive news for Manitoba growers. With the addition of the Green Bison facility – as well as two other facilities proposed by North Dakota Soybean Processors and Epitome Energy – exports for processing to the United States could significantly increase cross- border trade.

“Only $7 million [worth] of soybeans were exported to North Dakota from Manitoba in 2022, compared to $838 million to the rest of the world – primarily China. This might change with soybean crush in North Dakota coming online,” he says.

“What we see happening in North Dakota on the soybean crush side is what’s happening throughout the United States. The expansion of crush capacity across North America is unprecedented. No matter where it is, if it’s in North America, it’s a good thing. It’s more delivery options, supports farm gate values, and brings value added processing to rural communities. I think the icing on the cake is a lot of the interest in expansion is the interest in renewable fuels and decarbonizing fuels.”

CONCERNS OVER POTENTIAL POLICY SHIFTS

Global demand for whole soybeans is so strong that Sinner believes “it’s a good bet” they will increasingly become part of North Dakota’s crop mix. Concerns over potential drops in other markets remain, however, despite expectations of continued increased demand for soybean meal and oil.

“On renewable fuels, it’s the policies that get set which is the biggest unknown. We all know things can change quickly,” she says. For this reason, the North Dakota Soybean Growers Association, and other industry groups, continue to advocate for strong biofuel mandates. Vervaet expresses a similar sentiment.

“We always encourage governments, both provincially and federally, to consider making carbon intensity requirements more stringent,” he says. “We view the federal Clean Fuel Regulation as being the biggest driver at a national level.”